Mom Im Out of Money Again

Illustrations by Adam Simpson

En español | Amid constant media coverage of financial support that Americans are providing their adult children, it'south easy to overlook that millions of eye-aged Americans are giving coin to their parents. A new AARP Inquiry survey of adults ages 40 to 64 shows how widespread— and stressful—that assistance can be.

My parents had always been meticulous savers. On two modest salaries, they managed to buy a house, put their 3 girls through college and sock away a decent-sized retirement fund.

Simply after they retired, they did something completely uncharacteristic, if well-meaning: They invested almost all their savings in my youngest sis's new business, a children's day care heart. Past the fourth dimension information technology closed its doors for good a yr later, about iii years ago, my parents had lost everything.

At first my father was able to pay their mortgage with his pension from the retail store chain where he had worked equally a manager for 30 years (my mom had been in man resources). Both in their 70s, they received Social Security as well, notwithstanding despite living frugally, their debts began to pile upward, and the bank threatened to foreclose on the house they had lived in for decades.

My youngest sister was saddled with heavy debt herself, from the business. My middle sister is a school nurse (enough said) with three kids and a husband who is perpetually unemployed. That left me. My married man is a moving-picture show editor, and I'm a writer. We aren't exactly making buckets of cash, just we had always been able to eke out a living and back up our daughter.

I was the lone person in the family with decent credit, so when my parents were forced to sell their abode, I borrowed $50,000 for a down payment and bought them a smaller business firm. My husband said it was the right thing to do. Signing the loan agreement, though, made me nauseous.

When I bought the firm, my father said he would pay the mortgage from his pension. Of course, I nevertheless had to pay back the down payment. Dad positioned their new firm equally an investment that would be repaid to me when they were gone.

It turned out, however, that my parents were however so broke that they, in fact, couldn't pay the mortgage. So for the first yr, I duly wrote the checks. I'll just piece of work harder, I thought. It'due south simply money. I can make more. I started cranking out manufactures seven days a week. I had my own mortgage to pay, along with child care and hefty health insurance premiums (as freelancers, my hubby and I are on our ain).

So, i afternoon, my father phoned. Their car died, he told me, as a knot formed in my breadbasket. In that location was virtually no public transportation where they lived, nor any ride-hailing services. My married man and I, after some debate, decided to give them our car, which nosotros'd paid for in cash, and lease another one. What could I practice? They had to go around.

Going bankrupt

When I remember that period, I always call up of the line in Hemingway'sThe Lord's day Also Rises when a character is asked how he went broke: "Two ways," he said. "Gradually and then all of a sudden." That's what happened to united states. At present that we had car payments to make as well, I started paying other bills with credit cards. I began to wake upward every night at 3 a.m., ruminating about my finances for hours. My hair fell out in chunks. But I kept my worry from my parents considering I was afraid it would impact their wellness, which, especially for my dad, was starting to pass up.

Although I've always been close with my family unit, a current of resentment began to course underneath most all my interactions with them. I felt I was shouldering the burden for financial bug created by my parents and a sibling — a mess no one else was stepping upward to solve. At family gatherings, hot anger would suddenly eddy up in me. I'd notice, with narrowed eyes, that my youngest sis'south kids ever managed to have the latest electronics. When my center sister was telling me about her beach holiday, I'd think,Huh, not making too many sacrifices, are you? Must be nice!

So another twenty-four hours my begetter chosen. "I've got some unpleasant news," he told me equally I stood motionless, holding the phone. Their HVAC unit had stopped working, he said, and needed to exist replaced, for $7,000. He asked if I could human foot the nib (adding that it would "definitely add value when you sell the house"). I said that I'd endeavour to scrape together the money.

And then I hung up the phone and cried.

I felt and so trapped. Money is withal such a taboo subject in our civilisation, and financial problems can be securely isolating. I needed to talk to someone. A friend of mine had seen a fiscal therapist — someone who counsels people on the emotions behind money — and I fabricated an date.

It was a relief to cascade out my story to another human being. People think money is a rational, physical topic, she said, when, actually, it's a highly emotional subject field that's hardwired into our sense of survival. Coin is primal; it'due south well-nigh food and shelter, wellness and condom. It's non "but money," she offered bluntly. It never is.

The hard numbers of parental support

A new AARP enquiry study shows how many Americans give Mom and Dad fiscal aid. Amid abiding media coverage of financial support that Americans are providing their developed children, it'due south easy to overlook that millions of middle-aged Americans are giving money to their parents. A new AARP Research survey of adults ages xl to 64 shows how widespread— and stressful—that aid tin exist.

In survey, "Parents" are parents, stepparents and parents-in-law. Phone survey of 1,508 adults was conducted fall 2019.

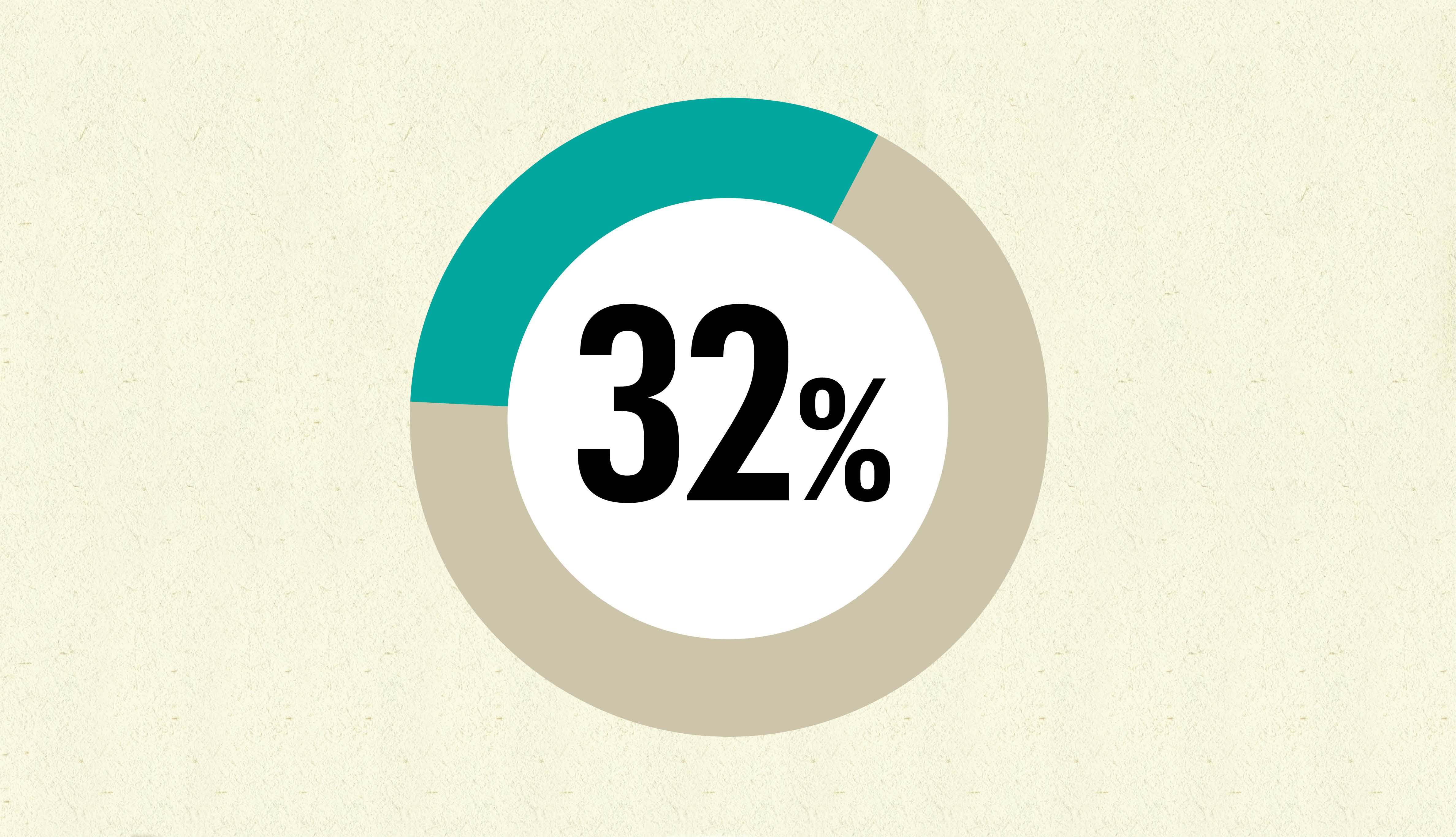

Many adults give money to their parents

Adults with living parents who have given them coin in the past 12 months:

Amounts can be substantial

Money given in the past 12 months

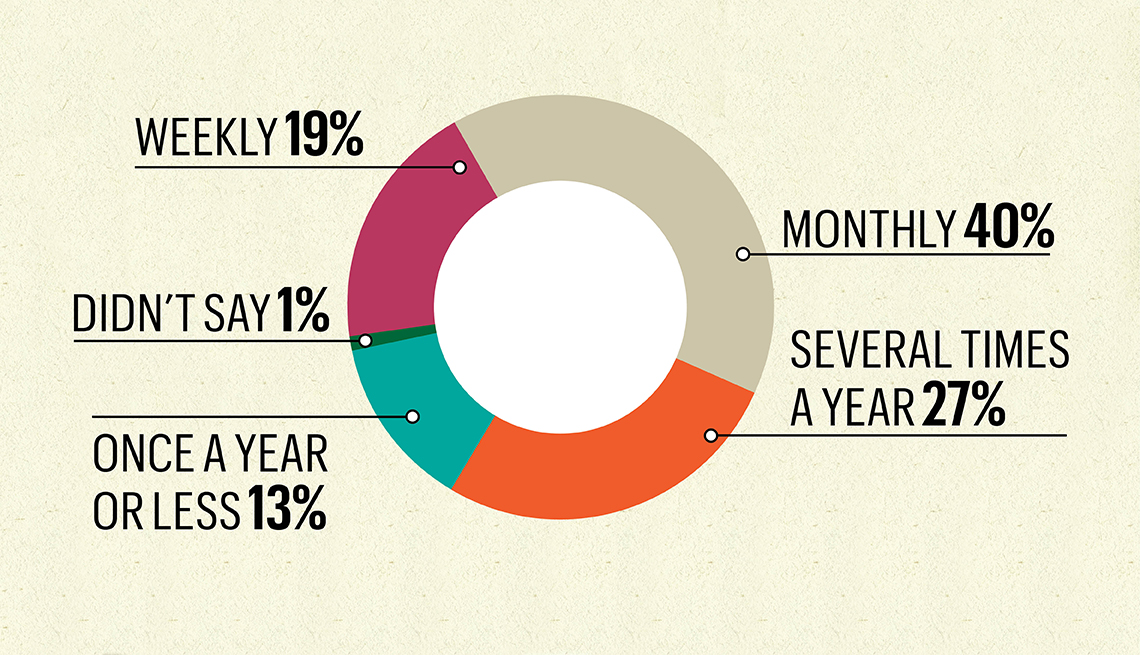

It'due south usually on a regular basis...

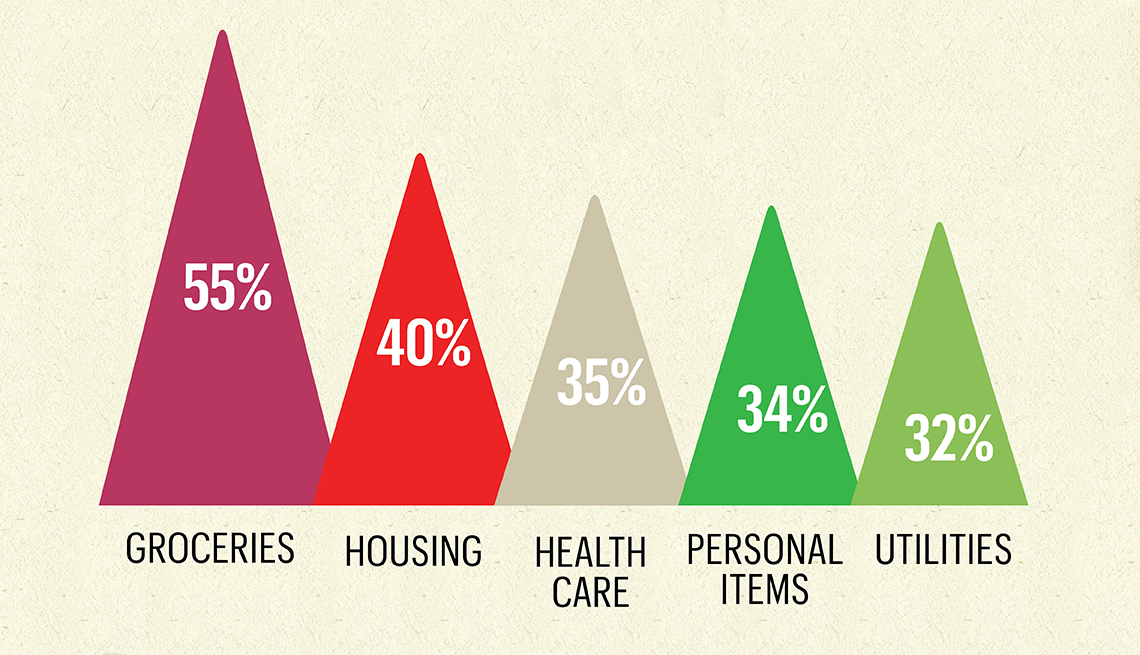

… And very often it's for basic necessities

How parents used funds (could exist more than one answer)

When I told the financial therapist nigh purchasing my parents' house — and how my male parent bodacious me it would eventually yield a render on my investment — she shook her head. "Yous never know what's going to happen and what type of care they might need down the line," she said. "Don't count on ever seeing a penny from the sale of that business firm and you'll exist happier. Consider that money gone."

That advice, while hard to hear, turned out to exist enormously freeing — and the moment that changed everything for me. Reframing information technology as a gift helped to tamp down my anxieties, expectations and resentment around repayment. If, ane twenty-four hours, I am actually remunerated, information technology will be a happy surprise.

Every bit my therapist helped me wait more realistically at other money matters and find ways I could presume control over my life, I felt physically lighter. We started by taking a hard look at my ain behavior. As the classic dutiful, responsible eldest, I had to admit that I liked the power of swooping in to take care of everything — simply that same pride kept me from telling my sisters that I was struggling.

After our session, I invited both sisters over for an unburdening go-together. They confessed that they were plagued by guilt, especially my sister who had started the business. The therapist had suggested that we brainstorm means to make our situation experience more than equitable. After a few cups of coffee, we agreed to think of time as another course of currency.

We decided that my sisters, who live closer to my folks, would have over tasks that required time — yard piece of work, decluttering my parents' house, planning and cooking for family unit holidays. And I privately vowed to curb my judgment on my siblings' expenditures. (My center sis, who works like a pack mule, was absolutely entitled to a embankment vacation.)

Then I steeled myself for a sit down-down with my parents. I was still worried that my confession would send them directly to the cardiologist, simply as the therapist pointed out, my health was failing, besides — and I was the family unit'south foundation. I took a deep breath and told them that I simply couldn't afford the HVAC merely would try to help them find a mode to pay for it. So my father appealed to an organization founded past his visitor that helps out its own retirees with financial hardships. (I certain wish he had told me about this resource earlier.) Though I know it injure his pride to ask, it worked.

And family unit relationships inflame those emotions, with shifting alliances, long-standing issues and competing values about what money "should" be for.

Lessons for You

Avert the mistakes I made if yous're going through this with your parents

Talk it out early.When my parents first asked for money, an hour of difficult chat could have saved me months of simmering resentment.

Don't give money backside your partner'due south back.When I did this once, information technology created a huge rift in my marriage. Secrecy damages trust.

Set Articulate limits. Specify how much and how often you'll give. Saying upfront that I had no financial elbowroom would have headed off many requests.

Save for your own retirement. My monthly contribution of $100 was plenty to make me feel I was caring for myself, too.

Seek parents' assist on other issues. Existence my parents' landlord: Bad-mannered! Just asking their communication on unrelated matters communicated my respect.

Getting candid

Sunshine is the best disinfectant, then later on my therapist told me to detect support outside the family unit, I likewise came clean with my friends, with whom I had virtually never discussed finances. 1 forenoon I received a group text for a brunch meetup. I was reflexively typing an alibi — "Sorry, besides busy, mayhap next time!" — when I thought,Enough.

"Love to, but just can't afford it right now," I wrote.

The commencement answer was from my friend Sarah, a teacher: "To be honest, I can't either." Some other friend said the same. Why, so, were nosotros piling on debt past going to a restaurant? Information technology was lunacy.

I proposed we meet in a park instead. During our go-together (we bought java to make it a little more festive) nosotros spoke, for the commencement time, about our money problems. It turned out that half of them were quietly supporting their parents besides. It was comforting to commiserate and to share advice.

Because money is indeed virtually survival, it can brand you coolly appraise the people who have lovingly raised yous. I try to fight those toxic feelings and put myself in my parents' shoes to brand them homo once more. What must information technology be like to lose everything when you've washed the correct thing your entire life? I'm sure it pains my dad, the lifelong conscientious saver, to take my money.

Lately I've made some changes, such as setting articulate boundaries with my folks about what I can give. I can't share many of my frustrations with them, but I can confide in my sisters and friends. I remind myself that my parents took care of me financially for two decades. I didn't realize until I became a parent how frequently you lot wearily open up your wallet for your child.

And I endeavor to exercise cocky-intendance and to stay physically and emotionally healthy. Thanks to an accelerate payment for a big work project, my husband and I have paid off the loan for the downward payment on my parents' firm. Simply our finances remain precarious. If I'm feeling panicky about cash flow, I perform a nutty footling ritual where I hold my own hand — a reminder that I need to care for myself, too.

My financial therapist was correct: It'south not "only money." Each check I requite my parents is more than than a simple sum. What I'm really giving them, I tell myself, is security, dignity and peace.

Free Planning Tool

AARP Money Map can help you accept control of unplanned expenses and get you lot on back on track to financial stability.

Source: https://www.aarp.org/money/credit-loans-debt/info-2020/giving-parents-financial-support.html

0 Response to "Mom Im Out of Money Again"

Post a Comment